In international trade, meeting the rules of origin is critical for accessing preferential tariff treatments under various trade agreements. The Tax Administration Service (SAT) in Mexico, a key player in global trade, conduct rigorous origin verification audits to uphold the integrity and compliance of its trade practices. Employing sophisticated data analytics and artificial intelligence, authorities are getting better than ever at uncovering discrepancies and enforcing regulations efficiently.

Understanding Origin Verification Audits

Origin verification audits are systematic checks carried out to verify that products imported into or exported from Mexico comply with the origin criteria stipulated in trade agreements.

- Qualifying for Reduced Tariffs: Products must meet specified origin rules to benefit from lower duties.

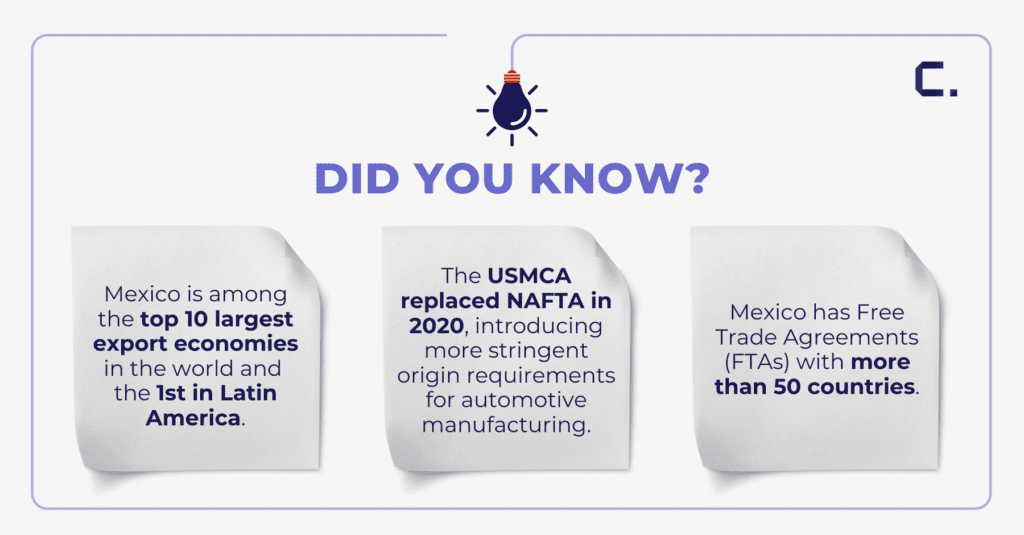

- Ensuring Trade Agreement Compliance: Adherence to these rules is essential for the execution of international trade agreements such as the United States-Mexico-Canada Agreement (USMCA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

Mexico increases customs revenue

Mexico's SAT strategically utilizes origin verification audits to boost customs revenue. These audits ensure compliance with trade agreements and help detect irregularities, targeting companies to verify that goods meet the requirements for preferential tariff treatment under agreements like the USMCA.

Audit Methods and Technology

- Extensive Reviews: The SAT undertakes thorough reviews of foreign trade operations aimed at uncovering misuse of treaty benefits and incorrect customs declarations.

- Use of Technology: Recent enhancements include the adoption of advanced data analysis and artificial intelligence to identify discrepancies and enforce compliance more efficiently.

Sector-Specific Inspections: In alignment with the Master Plan for the 2024 fiscal year, the SAT has announced inspections targeting specific sectors such as:

- Pharmaceutical industry

- Hydrocarbons

- Electronics

- Automotive industry These sectors are selected based on their risk profiles and potential for compliance issues, focusing efforts where the impact will be most significant.

Impact of Audits

While exact figures on the total amount recovered through these audits are often undisclosed, the effectiveness of these efforts is evident. The SAT has managed to reclaim substantial amounts by identifying and addressing non-compliance.

Significance and Future Outlook

The SAT's inspection and collection initiatives for 2024 are not just about enhancing revenue but are also crucial for ensuring adherence to tax and customs regulations. These efforts are part of a broader strategy to combat tax evasion and fraud, highlighting the significant role of origin verification audits in maintaining a fair and compliant trade environment.

Challenges and Best Practices

Especially for foreign entities, responding to a procedure by the government often involves numerous challenges. Providing comprehensive accounting documentation can be particularly difficult. This documentation includes detailed records of the purchase and payment for all materials used in production, production records, evidence of the sale and export of the finished product, and import documentation.

How to mitigate these challenges:

- Origin analysis and support documentation in place: invest in training their personnel on the complexities of origin rules and maintain meticulous records.

- Compliance experts accompanying the origin process: Engaging with trade compliance experts can help companies navigate the complexity of origin verification and mitigate risks.

- Technological integration: Leveraging automated systems for document management and traceability can streamline the audit preparation process and reduce human error.

The importance and benefits of having internal audits

Ensuring that companies adhere to the established rules of origin is crucial for maintaining lawful operations and upholding Mexico’s trade commitments.

Compliance with origin requirements allows companies to benefit from preferential tariffs, enhancing their competitiveness in international markets.

Conducting thorough audits fosters transparency and builds trust among trade partners, bolstering Mexico’s reputation in the global market.

Key Takeaways

Origin verification audits constitute Mexico’s commitment to fair and lawful international trade. By ensuring that goods comply with origin criteria, Mexico not only upholds its trade agreements but also fosters a transparent and competitive trading environment. For companies, understanding and preparing for these audits is essential to understand the benefits of preferential trade agreements and maintain a robust presence in the global market.

Tags

Share

CATTS Origin Support

By partnering with CATTS, you can ensure adherence to the required rules and benefit from our comprehensive expertise in managing the complexities of trade agreements and audits. Our combination of services and technology will help you correctly apply the rules of origin, maintain meticulous records, and make sure you are prepared for any audit.

Get Started