The European Union is undertaking a challenging initiative to revamp its customs union. The proposed reforms aim to broaden and deepen segmentation and prior certification use. Only operators holding an AEO certificate will be qualified to benefit from simplified procedures and enjoy facilitation in import and export. Economic entities recognized as Trust & Check Traders will have access to advanced customs services without intervention. A Customs Control Tower equipped with a skilled team and a sophisticated IT system will guarantee customs compliance and streamline operational management within this framework.

Responding to Global Trade Dynamics

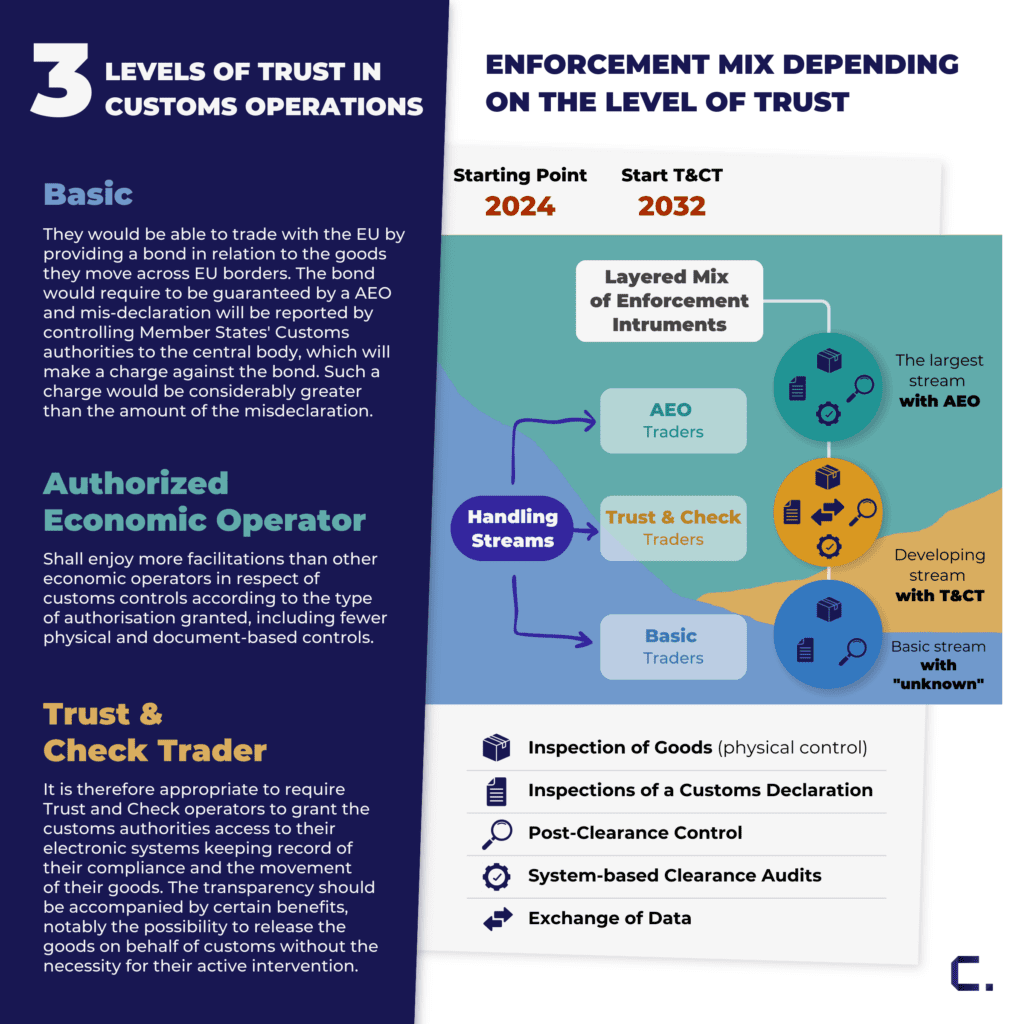

The European Union is embarking on an ambitious plan to overhaul its customs union by 2032, responding to evolving international trade dynamics, particularly due to the rise of e-commerce and the increasing influence of powerful countries and economic blocs globally. The volume of shipments requiring customs clearance is increasing dramatically while the resources and methods available for customs control remain unchanged. This escalation also amplifies threats to security, the environment, consumer safety, fair competition, and the financial stability of the Member States and the EU itself. In response, the EU plans to significantly enhance the digitalization of customs processes and the management of import duties. This will involve centralizing risk analysis through a new EU customs data hub and increasing the accountability of importers, including their early verification to streamline customs clearance and control.

The importance of the Authorized Economic Operator (AEO)

The segmentation of economic operators started long ago with the introduction of simplified customs procedures when trade facilitation was a top priority. Initially, importers could leverage either their own authorizations or those held by their customs brokers to simplify procedures. However, with the increasing emphasis on safety and security, AEO certification was introduced. Concurrently, as further Union Customs Code (UCC) regulations were implemented, the option to use simplified procedures through a customs broker's authorization was eliminated. Now, prior verification by Customs and compliance with AEO criteria have become essential for facilitating quicker customs clearance and reducing issues with the import of goods.

Planned Reforms and Certification Requirements

Under the planned reform, segmentation and prior certification are set to become more widespread and comprehensive. Only operators holding an AEO certificate will be eligible to utilize simplified procedures and receive facilitations in the import and export of goods. The customs control for these certified entities will primarily involve system-based clearance audits (including precertification and retention), post-clearance control of customs declarations, and selective inspections of transactions based on a customs declaration, with occasional inspection of goods. Currently, approximately 60% of shipments are processed using simplified procedures, and this majority is anticipated to shift to entities possessing an AEO certification.

Trust & Check Traders

Advanced customs services will be available to economic entities designated as Trust & Check Traders. It is anticipated that between several to approximately 15% of shipments will be managed by Trust & Check Traders, who will have the authority to conduct centralized self-clearance without Customs intervention. This process will not require issuing customs declarations but will rely solely on electronic information exchange and Customs' access to their records. Typically, the oversight of these transactions will involve system-based clearance audits (including precertification and retention), data exchange and access to records of import and export operations, post-clearance data control by Customs, and occasional transaction inspections along with episodic physical checks of goods. Still, some clearances will continue to be processed traditionally using standard customs declarations. However, these entities can anticipate stricter requirements during clearance, longer clearance processing time, more rigorous customs inspections of declarations and goods, and increased penalties for non-compliance.

Source: Heijmann, F., & Peters, J. Customs: Inside Anywhere, Insights Everywhere. Trichis Publishing, 2022.

Adapting to New Rules and Standards

The introduction of new rules for import and export, which focus on meeting safety and security standards, ensuring seamless deliveries, and reducing the risk of non-compliance that could lead to extended customs clearance times, detention costs, and potential sanctions, underscores the value of obtaining an AEO certificate before stricter requirements are implemented. Establishing a dedicated team within the company to manage customs compliance or forming a partnership with a supplier who supports customs functions and ensures expertise in customs matters will help adequately address these challenges. This strategic approach will prepare the company for evolving conditions and protect against escalating requirements.

Building a Customs Control Tower

Holding an AEO certificate and demonstrating customs expertise will facilitate the application for Trust & Check Trader status upon its introduction. Additionally, the requirement to exchange data on import and export operations or provide Customs access to this data necessitates gathering information from supply chain partners, verifying data quality, linking shipment data with transaction details, aggregating data at the HTS level, settling import duties, and auditing the accuracy of declarations and duty settlements. This comprehensive process demands a sophisticated system for collecting data from different sources, managing data associated with import and export operations, and communicating with Customs. Together, the team, competencies, and IT system will form a Customs Control Tower within the company, ensuring customs compliance and efficient operational management.

Preparing for the Future of Customs Compliance

In summary, the EU's proposed customs union reforms are poised to significantly transform the landscape of international trade by 2032. Companies engaged in import and export must proactively adapt to these changes by obtaining AEO certification and potentially qualifying as Trust & Check Traders. These steps will not only ensure compliance with the new regulations but also provide substantial operational benefits, including streamlined processes and reduced intervention by customs authorities.

Establishing a dedicated customs compliance team or partnering with experts can help businesses navigate the complexities of the new system. Building a robust Customs Control Tower within the organization will be essential for managing data, ensuring compliance, and maintaining efficient operations.By preparing now, companies can position themselves for success in the evolving global trade environment, mitigating risks and capitalizing on the opportunities presented by the EU's ambitious customs reforms.

About the Author

This article was written by Jacek Kapica, Director of Consulting at CATTS with over twenty years of experience in customs and trade regulation. Jacek has significantly impacted the field through his work in modernizing Polish Customs and now brings his expertise to CATTS. Learn more about Jacek and his contributions in our "Meet the Crew" series here.

Tags

Share

CATTS Trade & Compliance Solutions

With our expertise in customs and trade compliance, we offer tailored services to ensure that businesses are fully prepared for regulatory changes, such as the EU’s new customs reforms. Our services include guidance on achieving AEO certification, optimizing import/export procedures, ensuring compliance with new regulations, and developing strategies to streamline your customs operations.

Contact Us